MaxProfit

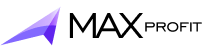

Futures Screener

Increase your deposit with passive income from funding rate arbitrage.

Get Access - 3 Days Free

Product Features

Passive income

Connect to 16 top CEX exchanges and track over 300 currency pairs.

Choice of different trading strategies

We track arbitrage opportunities in 3 directions: futures-futures; spot-futures; futures-spot.

Displays time until funding accrual

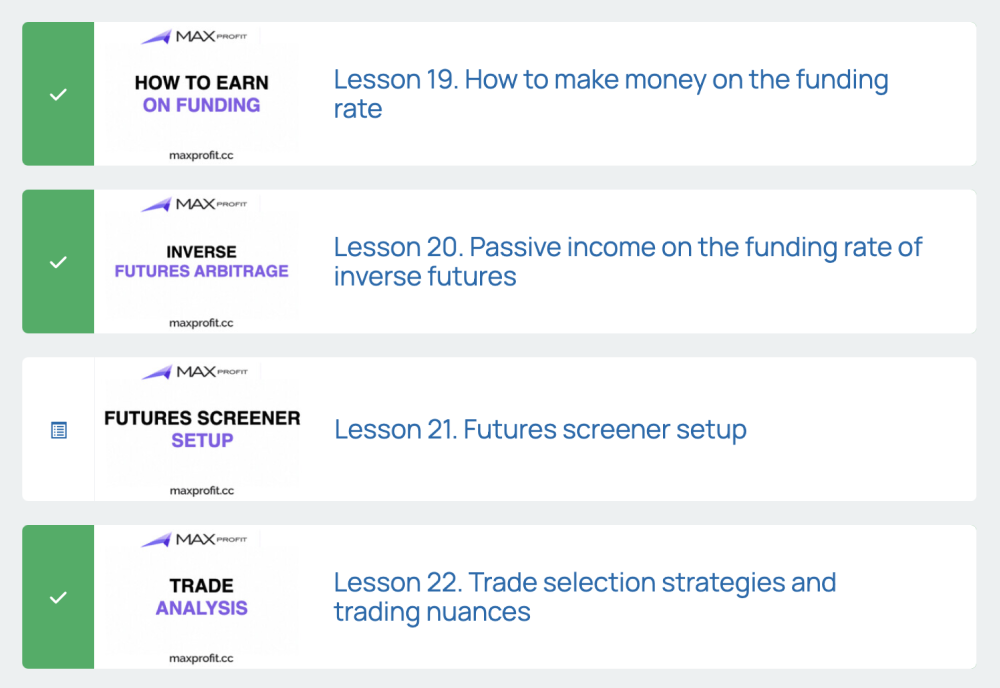

The bot tracks how much time is left until the next funding rate accrual.

19+ CEX exchanges and 3 DEX aggregators

The more exchanges, the more arbitrage opportunities, without competition for profitable trades.

Low risks and ease of entry

Funding arbitrage is one of the safest types of trading, providing stable passive income.

Over 1000 pairs per second

Quick market analysis helps find the best arbitrage opportunities and not miss profits.

Product Description

Futures Screener is a tool for tracking funding rate differences across various exchanges. It is used for funding arbitrage – one of the lowest-risk and most stable directions in trading.

Funding arbitrage attracts with its semi-passive nature: you only need to open and close a trade, and in between, wait for interest accruals.

Unlike classic spot arbitrage, here you don't need to rush – you will have from 4 to 8 hours to calmly analyze the market and enter a funding trade, as well as to complete it without haste.

Additionally, along with the futures screener, the tariff includes training on funding arbitrage. Our experts will explain in detail how to analyze each trade correctly and extract maximum profit.

The service will show you where to buy an asset, at what price, and where to short with a 1x margin, display the volume, lifetime of the pair, and the funding rate, which can be additionally earned.

To date, this is the most profitable type of arbitrage. Many of our users note that they manage to catch spreads of 15-25%, and some achieve a return of 10% on their deposit per month.

Case of using the futures screener:

Arbitrage on the MYRO token with +18% yield in one day

One of the users of the futures screener successfully found an arbitrage opportunity on the MYRO token, earning 18% profit in one day.

On KuCoin, the funding rate was 4.65%, while on Bybit, it was charged at 2%, providing a net funding yield of 2.65%.

The user opened a long position on KuCoin and a short position on Bybit with a margin of $850 on each exchange (with 5x leverage) at a price spread of 1.5%. After a day, following the accruals on KuCoin and charges on Bybit, the position was closed at a spread of -3%. As a result, $320 was earned with $1700 involvement, totaling +18% profit.